Electric Commercial Vehicle Market Size, Share, Growth, Trends and Forecast 2030

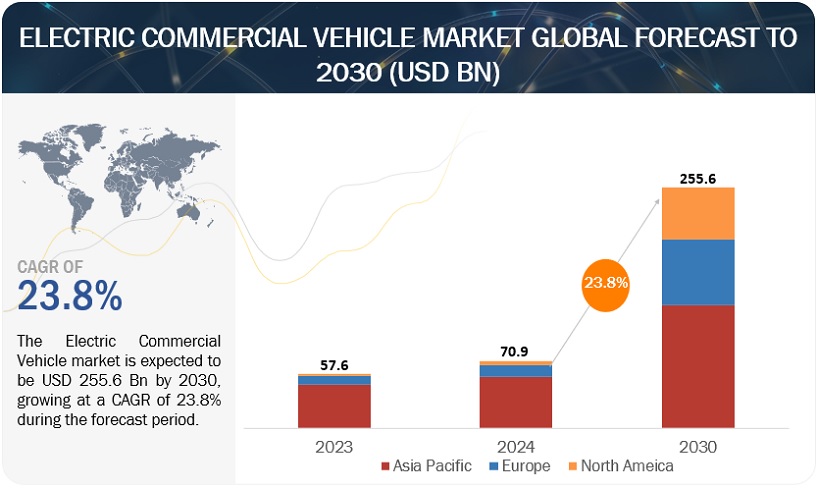

The global Electric Commercial Vehicle market is projected to grow from USD 70.9 billion in 2024 to USD 255.6 billion by 2030, registering a CAGR of 23.8%.

ECVs aim to provide a cleaner and more sustainable alternative to traditional fossil fuel-powered commercial vehicles, thereby reducing greenhouse gas emissions, air pollution, and reliance on finite fossil fuel resources. ECVs serve to lower the overall operational costs for businesses through reduced fuel and maintenance expenses. Electric vehicles have fewer moving parts and require less frequent maintenance compared to internal combustion engine vehicles, resulting in lower total cost of ownership over the vehicle’s lifespan. Additionally, ECVs benefit from increasing energy efficiency and advancements in battery technology, leading to longer driving ranges and faster charging times, which enhance their practicality and appeal for commercial applications.

“The Heavy-duty truck market is expected to show a significant growth rate during the forecast period.”

The heavy-duty truck market is projected to register a CAGR of 35.3% during the forecast period. Stringent emissions regulations and targets set by the European Union (EU) are expected to drive the adoption of electric heavy-duty trucks. Regulations such as the Euro 6 standards and potential future mandates for zero-emission vehicles can incentivize fleet operators to switch to electric trucks. Subsidies, grants, tax credits, and other financial incentives provided by governments can significantly reduce the upfront costs of purchasing electric heavy-duty trucks, making them more economically viable for fleet operators. The EU provides incentives for electric vehicles (EVs), such as battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs). EVs registered until December 31, 2025, are exempt from ownership tax for 10 years. This exemption is valid until 31 December 2030 in Germany. Thus, such government initiatives will support the market for electric trucks in ECV market.

Additionally, increasing demand for emission-free public transport options in developed and emerging economies is projected to rapidly boost the electric buses segment in the near future. Growing awareness of climate change and stricter regulations on emissions are pushing cities and governments to adopt cleaner transportation solutions. Electric buses offer zero tailpipe emissions, significantly reducing greenhouse gases and air pollution in urban areas. In January 2024, BYD Mexico delivered 20 electric buses to Mexico City Metrobus (Mexico). These buses have a low floor and a length of 15 meters. They can carry up to 130 passengers, have a range of 200 kilometers, and a battery capacity of 300 kWh. The charging time is three hours. This supply involves a total of 55 pure electric buses. Metrobus expects that the use of these new buses will prevent 5,845 tons of CO2 emissions annually.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=16430819

Development of wireless EV charging technology for on-the-go charging

Wireless charging eliminates the need for physical connections between the vehicle and the charging infrastructure, offering greater convenience and flexibility for fleet operators. This technology enables ECVs to charge automatically while parked or idling, minimizing downtime and maximizing operational efficiency. For businesses with large fleets, such as delivery services or public transportation agencies, wireless charging offers a seamless and hassle-free solution for keeping vehicles powered throughout the day, thereby enhancing productivity and reducing operational costs.

Moreover, wireless charging technology addresses some of the key challenges associated with the adoption of ECVs, such as range anxiety and limited charging infrastructure. By enabling continuous charging without the need for frequent stops at charging stations, wireless charging systems can extend the driving range of ECVs and alleviate concerns about battery range limitations. This increased range and flexibility make ECVs more practical and appealing for a wider range of applications, including long-haul transportation and urban delivery services. As wireless charging technology continues to advance and become more widespread, it has the potential to accelerate the adoption of ECVs and drive their growth in the commercial vehicle market.

“North America will be the prominent growing market for electric commercial vehicle during the forecast period.”

The North American electric commercial vehicle market is experiencing significant growth driven by various factors, including tightening emission regulations, increasing environmental awareness, and advancements in electric vehicle (EV) technology. With a focus on reducing greenhouse gas emissions and dependence on fossil fuels, governments, businesses, and consumers in North America are increasingly turning to electric commercial vehicles as a sustainable transportation solution. In North America, there has been significant investment in charging networks, including fast-charging stations along major transportation routes and in urban areas. For instance, in January 2024, the US government invested USD 623 million in charging infrastructure. In February 2024, the first public 500 kW charging station for North America was unveiled at Mercedes-Benz USA Headquarters in Sandy Springs, Georgia. In May 2023, PACCAR Inc. (US) and Toyota Motor North America, Inc. collaborated to expand their joint efforts to develop and produce hydrogen fuel cell (FCEV) Kenworth and Peterbilt trucks, which are powered by Toyota hydrogen fuel cell modules. North America is home to renowned OEMs that specialize in producing high-quality and high-performance vehicles, driving the growth of the electric commercial vehicle market. These manufacturers, including Tesla, Inc. (US), PACCAR Inc. (US), Ford Motor Company (US), WorkHorse Group (US), and General Motors (US), are increasingly focusing on developing faster, cleaner, and more efficient electric commercial vehicles. The region is also home to top electric medium-duty and heavy-duty truck manufacturers such as Chanje Energy Inc. (US), Mitsubishi (Japan), and Orange EV (US). Thus, all such factors are expected to boost the North American electric commercial vehicle market during the forecast period.

Key Market Players

The electric commercial vehicle market is dominated by established players such as BYD (China), Mercedes-Benz Group AG (Germany), Yutong (China), AB Volvo (Sweden), and Ford Motor Company (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=16430819

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/electric-commercial-vehicle-market-16430819.html